If you’re looking for a new way to potentially make a profit, you may want to explore the world of Contract for Difference (CFD) trading. Cfd trading allows you to speculate on the rising or falling prices of various assets – such as stocks, commodities, and cryptocurrencies – without actually owning the asset itself. This means you can potentially make a profit even if the market is down. In this blog, we’ll dive into the world of cfd trading so you can determine if it’s right for you.

First, let’s break down what Cfd trading is and how it works. In a CFD trade, you and your broker agree to exchange the difference between the opening and closing price of a specific asset. If you think the asset’s price will rise, you buy a CFD; if you think the price will fall, you sell a CFD. If you’re correct in your speculation, you’ll make a profit equal to the difference between the opening and closing prices. However, if you’re wrong, you could potentially lose money.

One advantage of Cfd trading is that you can trade on leverage. This means you only need to put down a fraction of the full value of the asset you’re trading. Let’s say you want to trade $10,000 worth of stock, but you only need to put down $1,000 to do so. This means you can potentially make a profit on a $10,000 position with only $1,000 of your own money. However, trading on leverage also means that losses can be amplified, so it’s important to manage your risk carefully.

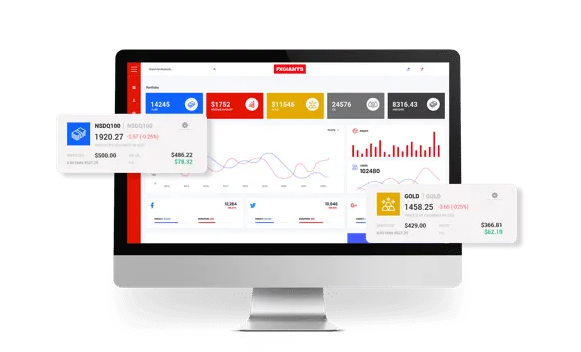

Another advantage of Cfd trading is that it allows you to trade a wide range of assets from one account. Instead of opening separate accounts for stocks, commodities, and cryptocurrencies, you can trade them all from one platform. This can be convenient and cost-effective, especially if you’re interested in multiple types of assets.

There are also risks involved in Cfd trading that you should be aware of. As mentioned before, trading on leverage can magnify your losses. Additionally, CFDs are not regulated in the same way as traditional forms of trading. This means there is more potential for fraud and mismanagement from certain brokers. Therefore, it’s important to do your research and only trade with reputable brokers.

short:

While Cfd trading can offer potential profits, it’s important to understand the risks involved. If you’re considering Cfd trading, make sure you do your research and understand the platform you’re using, as well as the asset(s) you’re trading. It’s also important to manage your risk carefully by using tools such as stop loss orders. With the proper understanding and strategy, Cfd trading can be a valuable addition to your investment portfolio.